46+ can i deduct mortgage interest on second home

Web Property taxes. Web It isnt necessary for you to actually use the second home but it cant be up for sale or made available to prospective renters during the tax year you deduct the interest.

The Future Of American Housing A Mcmansion Withdrawal Rethinking Commutes Designing Housing With Lower Incomes In Mind And The Impact Of A Fully Subsidized Mortgage Market Dr Housing Bubble Blog

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

. Ad Get An Estimate To See How Much Cash You Could Unlock From The Equity In Your Home. In fact unlike the mortgage interest rule you can deduct property taxes paid on any. If itemizing a single filer.

Web If youve closed on a mortgage on or after Jan. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Ad From Enquiry to Live within 24 hours get your Property Online with a Quick Turn Around.

Web Generally home mortgage interest is any interest you pay on a loan secured by your home main home or a second home. Maintenance and repairs costs Allowable expenses include the. Web So if you have a mortgage keep good records the interest youre paying on your home loan could help cut your tax bill.

Web You cant deduct the charge as a real property tax when its a unit fee for the delivery of a service such as a 5 fee charged for every 1000 gallons of water you use a periodic. As noted in general you can deduct the. Ad From Enquiry to Live within 24 hours get your Property Online with a Quick Turn Around.

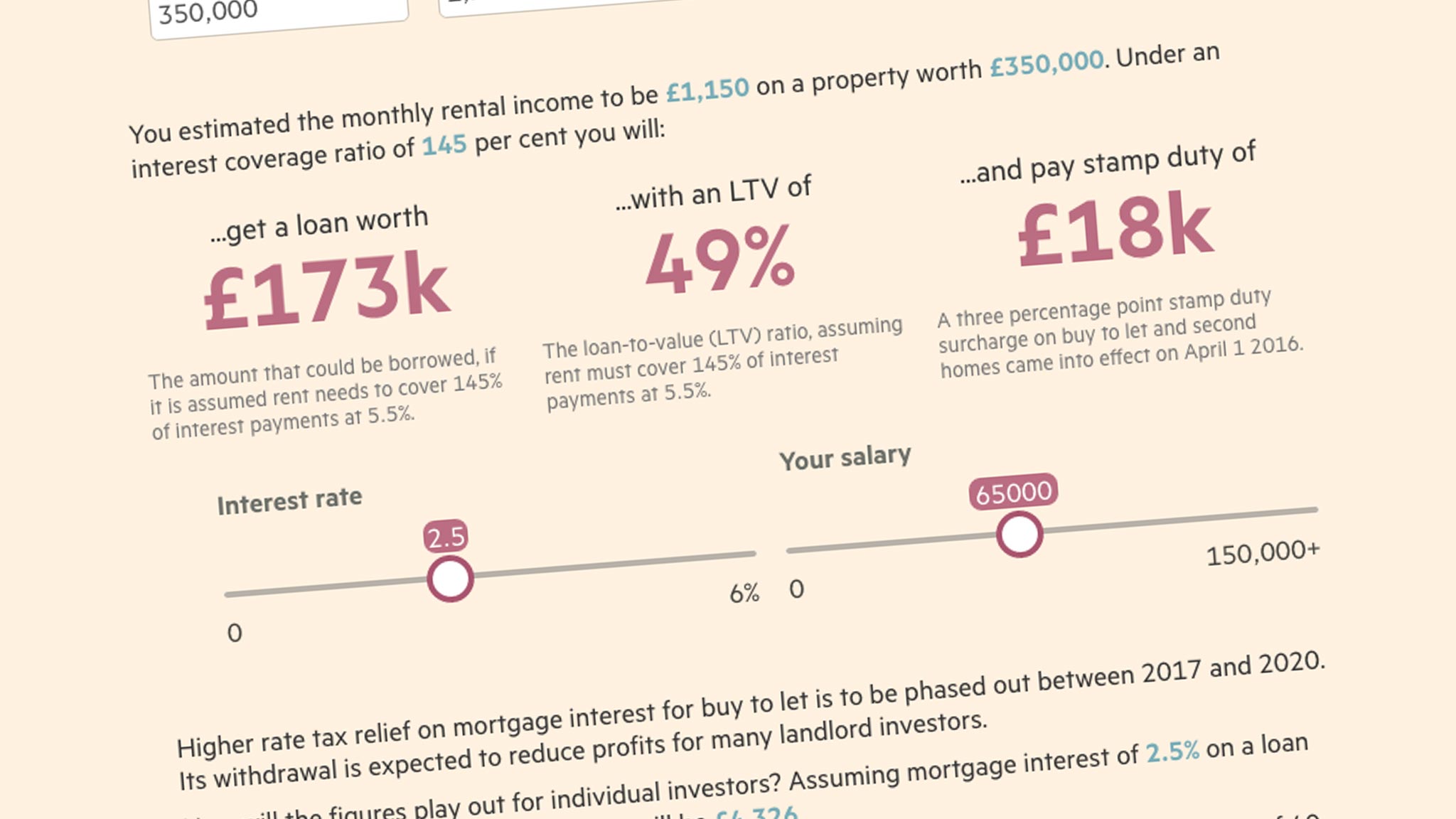

You can deduct interest paid on a second home up to the annual limit. Web If the mortgage is for a residential property then the restrictions on interest from April 2017 will apply. As long as you dont rent out a second home for more than 14 days each year you can deduct the mortgage interest you pay on it.

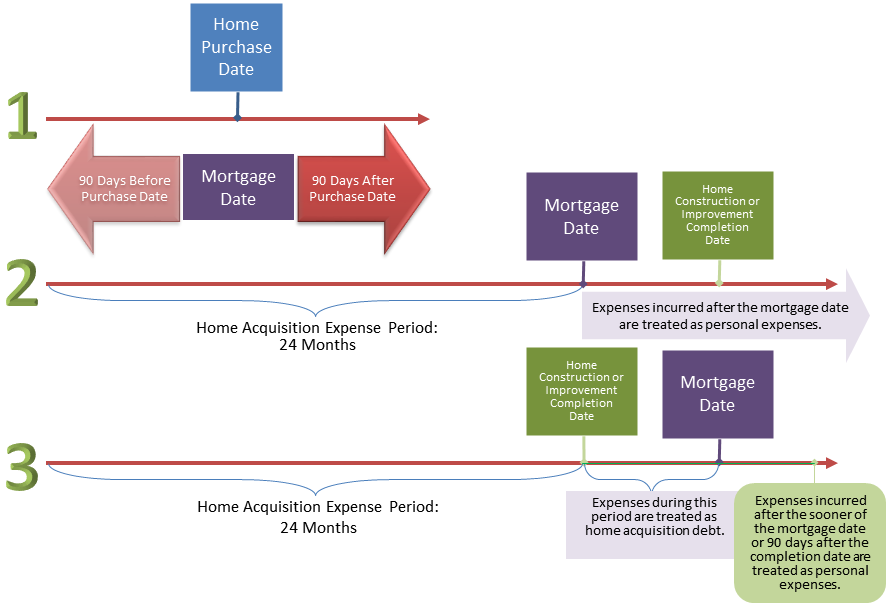

Web Generally for the first and second categories you can deduct mortgage interest on up to 1 million 500000 for those married filing separately. Web The amount of the deductible mortgage interest depends upon when you bought your second home. Web Homeowners can deduct up to 10000 total of property taxes per year on federal income taxes including taxes on a second home.

Web You arent limited to deducting the interest on the first home. Web If you paid 4 interest on mortgages that cost 1 million in the home acquisition debt you could deduct 40000 of interest from your annual payments. If you bought it before December 15 2017 you can deduct.

Web Yes you can include the mortgage interest and property taxes from both of your homes. Get Support And Advice From The UKs Leading Independent Holiday Letting Agency. Web This itemized deduction allows homeowners to count interest they pay on a loan related to building purchasing or improving their primary home against their taxable.

However there is a. You can deduct property taxes on your second home too. Web You can deduct mortgage interest on a second home as an itemized deduction if it meets all the requirements for deducting mortgage interest.

The loan may be a mortgage to buy your home. Fill In Our Form Find Out How Much Equity You Could Release From Your Home. If you rent out your second.

Get Support And Advice From The UKs Leading Independent Holiday Letting Agency. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. However the deduction for mortgage interest starts to be limited at either.

Deduct Mortgage Interest On Second Home

What Is Mortgage Interest Deduction Zillow

Is Interest Paid On A Second Home Deductible From Federal Income Tax

Itemized Deductions For Interest Expenses On Home Mortgages And Home Equity Loans

Top Tax Deductions For Second Home Owners

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

Is Your Buy To Let Investment Worth It Use This Calculator To See If Your Sums Add Up

Primary Residence Value As A Percentage Of Net Worth Guide

Can You Deduct Mortgage Interest On A Second Home Moneytips

Second Mortgage Tax Benefits Complete Guide 2023

Can You Deduct Mortgage Interest On A Second Home Moneytips

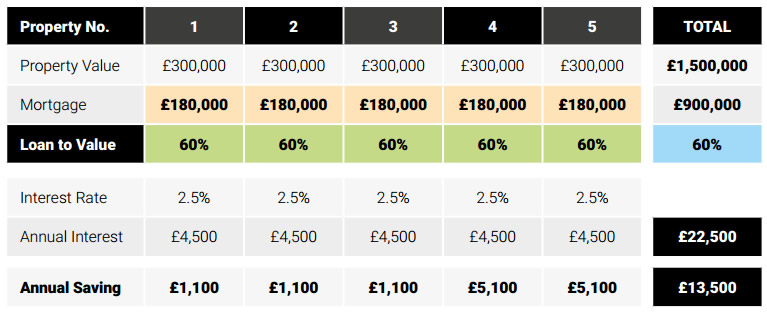

Strategic Re Mortgaging To Mitigate Section 24 Mortgage Interest Relief Restrictions Fylde Tax Accountants

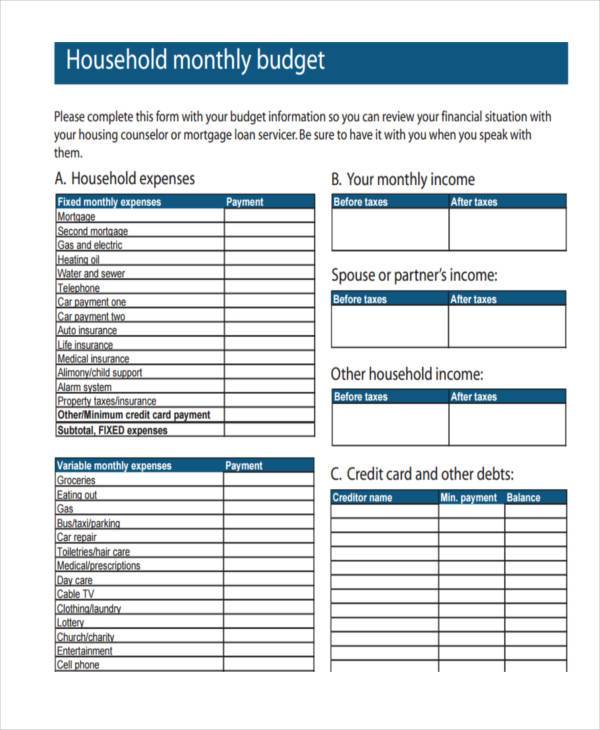

Free 46 Budget Forms In Pdf Ms Word Excel

Second Home Tax Benefits You Should Know Pacaso

Second Home Tax Benefits You Should Know Pacaso

Pdf The Municipal Integrated Development Programme As An Economic Driver In Prioritising The Provision Of Water Services To The Community Theuns Pelser Academia Edu

Can You Deduct Mortgage Interest On A Second Home Moneytips